Menu

The current Coronavirus Job Retention Scheme (CJRS) will come to an end on 31 October 2020. The new Job Support Scheme (JSS) will commence from 1 November 2020 and will run for 6 months until 30 April 2021. The scheme aims to help businesses keep employing people on shorter hours rather than making them redundant.

Whilst the detail of the scheme will no doubt evolve over time, in brief the scheme details we know of so far, are:

At the time of writing we are aware of the following conditions:

We await further details of the scheme to understand what, if any, additional conditions will be applied.

To give employers an idea of how the scheme would work in practice, we have provided some examples below:

Jack normally works 40 hours a week for VHR Ltd for £2,000 per month. VHR Ltd currently only has 20 hours a week for Jack. Jack is therefore paid £1,000 per month for 20 hours worked per week.

He is then paid a total of £666.66 per month in respect of the 20 hours a week NOT worked (two thirds) £333.33 is paid by VHR Ltd plus £333.33 is claimed from the government. The missing £333.34 is what Jack must forego to make the scheme work. So, in this example, Jack gets 83.3% of his full normal pay for working 50% of his normal hours. 19.9% is paid by the government.

Elaine normally works 39 hours a week for VHR Ltd for £9,000 per month. VHR Ltd currently only has 26 hours a week for Elaine. Elaine is therefore paid £6,000 per month for her 26 hours worked per week.

She is then paid a total of £1,697.92 per month in respect of the 13 hours a week she doesn’t work. £1,000 is paid by VHR Ltd (one third) plus another £697.92 (i.e. the capped amount) is claimed from the government. The missing £1,302.08 is what Elaine must forego to make the scheme work. In this example Elaine gets 85.5% of her normal full pay for working 66% of the hours. 9% is paid by the government.

Ben normally works 30 hours a week for VHR Ltd for £1,500 per month. VHR Ltd currently only has 10 hours a week for Ben. Ben is therefore paid £500 per month for his 10 hours

worked per week. He is then paid a total of £666.66 per month in respect of the 20 hours a week he doesn’t work. £333.33 is paid by VHR Ltd (one third) and another £333.33 is claimed from the government.

The missing £333.33 is what Ben must forego to make the scheme work. In this example Ben gets 77.7% of his normal full pay for working a third of the hours. 28.5% is paid by the government.

Janine normally works 40 hours a week for VHR Ltd for £3,000 per month. VHR Ltd currently only has 10 hours a week for Janine. Janine is therefore paid £750 per month for her 10 hours worked per week. No grant can be claimed as Janine is working less than a third of her normal contracted hours.

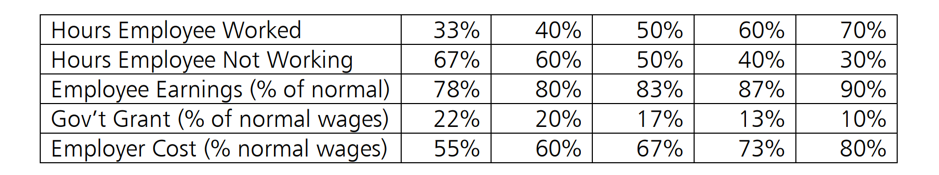

The table below helps to understand the amounts to be paid depending on the percentage of reduced hours worked by the employee.

However, whilst it is yet to be clarified, we anticipate that the right an employee has to request statutory redundancy terms (after four weeks in a row or six weeks in a thirteen week period) under the grandfather scheme will NOT apply under the Job Support Scheme.

Employers will need to consider whether the scheme is of benefit and whether it should be applied to some employees who have returned to normal working; it is not limited to just employees who are still furloughed. If the scheme is not seen as a practical option, and employees cannot return to work from furlough, then employers will need to take immediate action now.

Given the scheme still amounts to a deduction in salary, employers should continue the practice of writing to employees to seek their agreement to the deduction in pay if they wish to utilise the scheme. HMRC have made it clear that the agreement must be made available to them on request.

Employers may wish to consider approaching employees currently furloughed to explain that the current scheme is coming to an end and to establish whether employees would like to be considered for the scheme if a return to normal working is not going to be viable.

Employers would also be well advised to start preparing alternative plans including consulting about redundancy if they have not already done so.

If you would like further advice on any of the issues discussed here or payroll solutions, then email us at enquiries@verohr.co.uk

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| bcookie | 2 years | LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. |

| lang | session | This cookie is used to store the language preferences of a user to serve up content in that stored language the next time user visit the website. |

| lidc | 1 day | LinkedIn sets the lidc cookie to facilitate data center selection. |

| Cookie | Duration | Description |

|---|---|---|

| _ce.cch | session | CrazyEgg |

| _ce.gtld | session | CrazyEgg |

| _ce.s | 1 year | CrazyEgg |

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_UA-174055290-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| _hjAbsoluteSessionInProgress | 30 minutes | Hotjar sets this cookie to detect the first pageview session of a user. This is a True/False flag set by the cookie. |

| _hjFirstSeen | 30 minutes | Hotjar sets this cookie to identify a new user’s first session. It stores a true/false value, indicating whether it was the first time Hotjar saw this user. |

| _hjid | 1 year | This is a Hotjar cookie that is set when the customer first lands on a page using the Hotjar script. |

| _hjIncludedInPageviewSample | 2 minutes | Hotjar sets this cookie to know whether a user is included in the data sampling defined by the site's pageview limit. |

| li_gc | 2 years | Used to store consent of guests regarding the use of cookies for non-essential purposes. |

| li_sugr | 3 months | LinkedIn Insight Tag, when IP address is not in a Designated Country. |

| vuid | 2 years | Vimeo installs this cookie to collect tracking information by setting a unique ID to embed videos to the website. |

| Cookie | Duration | Description |

|---|---|---|

| bscookie | 2 years | This cookie is a browser ID cookie set by Linked share Buttons and ad tags. |

| Cookie | Duration | Description |

|---|---|---|

| AnalyticsSyncHistory | 1 month | No description |

| UserMatchHistory | 1 month | Linkedin - Used to track visitors on multiple websites, in order to present relevant advertisement based on the visitor's preferences. |

| wmc | 10 years | No description available. |